There’s still time to register for the Smarter Payments Summit!

Can you make the date to join us at the Smarter Payments Summit? You will have the opportunity to meet with leading payments providers to discuss your business needs, plus learn from the best during inspiring seminar sessions. DATE: 10th March 2025 VENUE: Hilton, London Canary Wharf Your pass will be fully funded by us to attend as our guest, which […]

January is Digital Identity Verification Month on Fraud Prevention Briefing – Here’s how to get involved!

Each month on Fraud Prevention Briefing we’re shining the spotlight on a different part of the market – and in January we’ll be focussing on Digital Identity Verification. It’s all part of our ‘Recommended’ editorial feature, designed to help industry buyers find the best products and services available today. So, if you specialise in Digital Identity Verification and […]

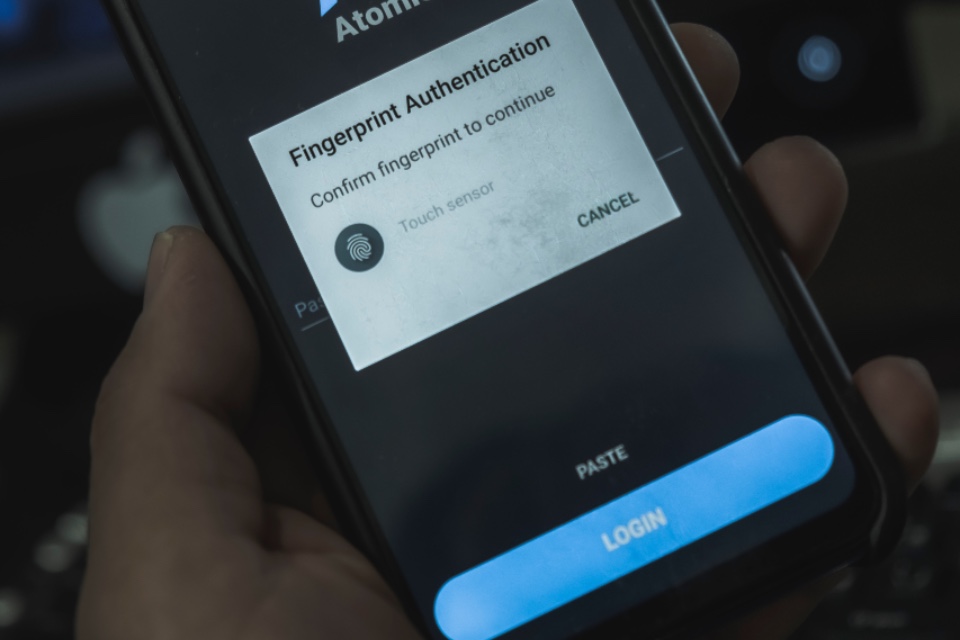

MOBILE MONTH: A deep dive into Device Fingerprinting and Risk Scoring

Fraud prevention solutions have become increasingly sophisticated to counteract evolving threats. Among the most impactful technologies are device fingerprinting and risk scoring algorithms, which we touched on last week, enabling on-device fraud detection and prevention. These tools empower merchants to identify suspicious devices and activities in real-time, safeguarding transactions and improving customer trust – here’s a deeper dive […]

MOBILE MONTH: From Behavioural biometrics to app security, what’s driving innovation?

Prevention of fraud on mobile phones has become a critical focus for e-commerce and payments providers, as mobile transactions continue to dominate the digital marketplace. In 2024, advancements in on-device fraud prevention solutions have emerged to tackle increasingly sophisticated threats like account takeovers, mobile malware, and phishing attacks. Here are the key trends shaping this […]

FCA conducts further consultation on enforcement transparency proposals

The FCA has published the second phase of its consultation on proposals for a measured increase in transparency about its enforcement investigations, and set out plans for further engagement after significant concerns were raised in relation to the original consultation. The further consultation also aims to assist ongoing parliamentary scrutiny, including by the Commons’ Treasury […]

European Digital Identity Wallets: Commission adopts technical standards

The European Commission adopted rules for the core functionalities and certification of the European Digital Identity (eID) Wallets under the European Digital Identity Framework, which it says is a major step towards Member States building their own wallets and releasing them by the end of 2026. Four implementing regulations set out uniform standards, specifications, and procedures […]

SAVE THE DATE: Fraud Prevention Summit 2025

You can now register for the next Fraud Prevention Summit, which is taking place on November 10th 2025 at the Hilton London Canary Wharf. Your complimentary guest pass includes: – An itinerary, designed by you, of pre-qualified one-to-one meetings with solution providers – A seat at the industry seminar sessions – Lunch and refreshments throughout – Networking […]

FRAUD PREVENTION: Identifying your risks and priorities to help leverage the best solutions

Fraud prevention is a critical focus for the UK’s retail and e-commerce sectors, with cybercriminals employing increasingly sophisticated tactics. For senior fraud prevention professionals, sourcing the right anti-fraud solution partner is key to protecting revenue, customer trust, and operational efficiency. Here’s how to approach the task effectively, based on input from delegates and suppliers at […]

International Fraud Awareness Week: A Call to Action for Anti-Fraud Professionals

International Fraud Awareness Week is a pivotal time for UK retail professionals to reflect on the rising threats of fraud and strengthen their organisations’ defences. In an industry where high transaction volumes, digital innovation, and complex supply chains create fertile ground for fraudsters, this week serves as a vital reminder to enhance vigilance and build a […]

FCA issues Metro Bank with hefty fine for transaction monitoring failings

Metro failed to have the right systems and controls to adequately monitor over 60m transactions, with a value of over £51bn, for money laundering risks between June 2016 and December 2020, with the Financial Conduct Authority issuing a £16,675,200 fine as a result. The FCA says Metro automated the monitoring of customer transactions for potential […]