Companies House identity checks ‘pose major cybersecurity risk’

The Government has just announced its digital identity checks for Companies House will go live on 18 November, affecting up to 7 million people over the next year. But while the aim is to improve transparency and tackle fraud, the system behind it is raising security concerns. The rollout depends on ‘GOV.UK One Login’, a system that one commentator […]

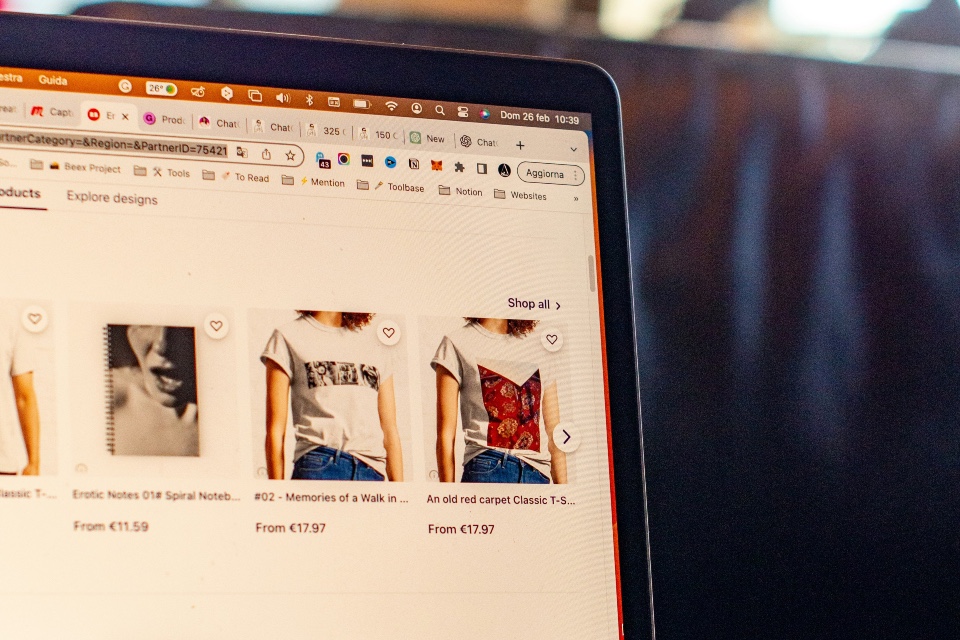

ANTI-FRAUD PLATFORMS MONTH: Omnichannel, Omnirisk – Tackling fraud across storefronts, apps and marketplaces

As retail becomes increasingly omnichannel, fraudsters are evolving just as quickly, exploiting gaps between physical and digital systems to target vulnerabilities across every touchpoint. For retailers and e-commerce providers attending the Fraud Prevention Summit, the challenge is clear: fraud is no longer isolated to one channel, and your anti-fraud strategy can’t be either… The rise […]

VIDEO: Fraud Prevention Summit – Your trusted source of truth when it comes to the best solutions

The Fraud Prevention Summit is a focused event, specifically organised for senior professionals directly responsible for their organisation’s fraud prevention requirements – and that means you! It’s a focused opportunity for you to meet potential parters who provide the latest and greatest products and services within the sector. You will also hear from leading experts as […]

RISKIFIED WEBINAR REWIND: AI’s Impact on Fraud in EMEA – Upping the Ante

Don’t worry if you missed Riskified’s recent webinar about the impact of AI on fraud in the EMEA region – you can now watch the entire session on demand. This insightful webinar, featuring industry experts from Air Europa and AstroPay, provided a deep dive into the escalating sophistication of online fraud, predominantly fuelled by advancements in Artificial Intelligence. […]

FRAUD DETECTION TOOLS MONTH: Tackling rising abuse in returns, chargebacks and first-party fraud

As e-commerce continues to grow, so too does a troubling trend: the surge in post-purchase fraud. From inflated return volumes and false ‘item not received’ claims to first-party chargeback abuse, fulfilment-related fraud has become a major concern for retail fraud teams attending the eCommerce Forum and Smarter Payments Summit. These tactics not only erode margins […]

PwC outlines the 5 biggest e-commerce fraud risks

As online retailers battle to navigate an increasingly complex economic, geopolitical and cyber landscape they will face new regulations coming into force on 1st September around fraud risk responsibility. That’s according to a PwC UK and Forter research paper that builds on their joint 2024 research, identifying the latest external threat trends for retail fraud leaders. Along with highlighting underlying […]

Fraud Prevention Summit: Your source of knowledge & expertise

The Fraud Prevention Summit is where leading experts will share their insights and expertise on the world of merchant fraud: This year, we’re featuring Criminologist and Forensic Linguist, Dr Elisabeth Carter, who will present on Language for Criminal Gain: This presentation exposes the language in fraudulent communications; exploring how legitimacy and credibility are maintained while the interaction moves to […]

August 2025 is Anti Fraud Platforms Month on Fraud Prevention Briefing – Here’s how to get involved!

Each month on Fraud Prevention Briefing we’re shining the spotlight on a different part of the market – and in August we’ll be focusing on Anti Fraud Platforms. It’s all part of our ‘Recommended’ editorial feature, designed to help industry buyers find the best products and services available today. So, if you specialise in Anti Fraud Platforms and […]

FRAUD DETECTION TOOLS MONTH: How to procure the right solutions for your business

Selecting the right fraud detection partners is a critical decision for retailers navigating an increasingly complex digital landscape. With rising volumes of e-commerce transactions, hybrid payment models, and growing international operations, retailers attending the Fraud Prevention Summit need tools that can prevent fraud effectively without compromising customer experience… Key Considerations for Vendor Selection The most […]

FRAUD DETECTION TOOLS MONTH: How data sharing and consortium models are powering next-gen retail fraud detection

As fraud threats become more complex and cross-border, UK-based retailers are increasingly recognising that tackling the problem in isolation may no longer be enough. In 2025, collaborative intelligence is emerging in the fight against e-commerce fraud, with data sharing and consortium models enabling faster detection, broader visibility, and greater resilience… Retail fraud now extends beyond […]