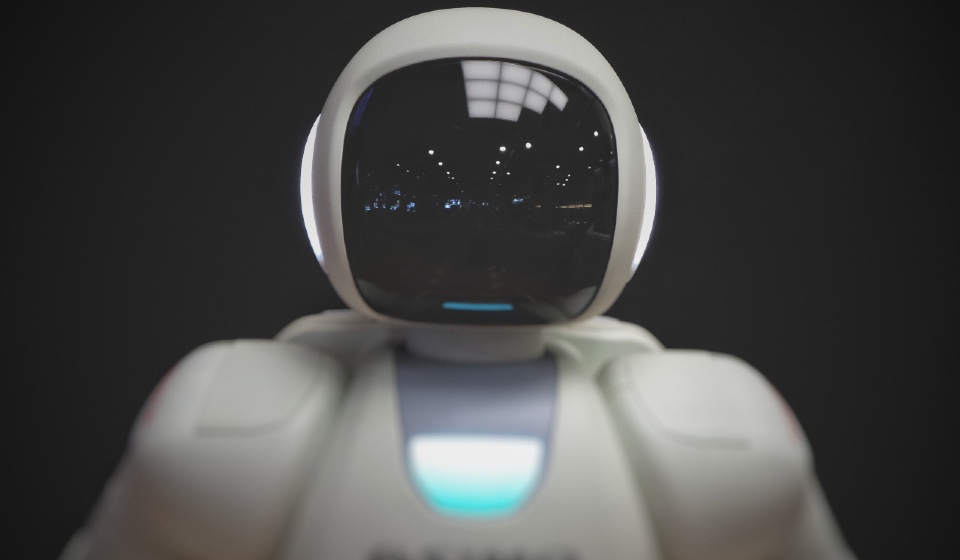

Businesses and financial institutions face a constantly mutating landscape of fraudulent activities. Traditional systems, once hailed as robust, now frequently lag behind in detecting and preventing contemporary fraud schemes. Enter Artificial Intelligence (AI): a transformative force that’s reshaping fraud prevention by providing real-time, predictive, and adaptable solutions. Here we explore the growing influence of AI in combatting fraud and safeguarding assets, based on input from delegates and suppliers at the Merchant Fraud Summit…

- Real-time Transaction Analysis: AI can process vast amounts of data at lightning speeds. This allows it to assess each transaction in real-time, comparing it against patterns of normal behaviour. If a transaction looks suspicious (say, an unusually large purchase made in a foreign country late at night), the AI system can flag it instantly for review or even block it until it’s verified.

- Deep Learning for Pattern Recognition: Fraudsters are known for their adaptability, constantly changing tactics to evade detection. Deep learning, a subset of AI, empowers systems to ‘learn’ from vast datasets, recognising patterns and anomalies without being explicitly programmed. This means that even if fraudsters alter their tactics, AI systems trained using deep learning can detect these new patterns, keeping businesses one step ahead.

- Predictive Fraud Analysis: Beyond merely detecting known fraudulent tactics, AI leverages predictive analytics to forecast potential future threats. By analysing historical fraud data and blending it with current transaction trends, AI can offer predictions about where and when the next potential fraud might occur. This proactive approach allows businesses to bolster security in vulnerable areas before a breach happens.

- Enhanced Authentication Protocols: AI has amplified the capabilities of biometric authentication methods like facial recognition, voice analysis, and fingerprint scanning. By continuously learning and updating individual profiles, AI ensures that only the authentic user can access accounts, thereby drastically reducing identity theft or account takeovers.

- Natural Language Processing for Phishing Detection: Phishing emails are a common tool in a fraudster’s arsenal. AI, equipped with Natural Language Processing (NLP), can scan emails and detect subtle linguistic cues that might indicate a phishing attempt, protecting users from potential threats.

- Automated Reporting and Decision Making: Post-incident reports are crucial for understanding breaches and strengthening defences. AI can automate this process, collating data, suggesting remedial measures, and even implementing certain protective protocols without human intervention.

- Adaptable and Self-learning Systems: One of the greatest advantages of AI is its inherent adaptability. As it encounters new types of fraud or even near-miss events, it learns, refines its algorithms, and becomes even more effective in subsequent detections.

AI is not merely a tool but a dynamic shield adapting and evolving in the face of emerging threats. As businesses and transactions continue their inexorable shift online, AI stands as a sentinel, safeguarding assets and instilling trust in systems. The fusion of AI and fraud prevention is an exemplar of how technology can be harnessed to protect, predict, and prevail against malicious intent.

Are you looking for mobile anti-fraud solutions for your business? The Merchant Fraud Summit can help!

Photo by Possessed Photography on Unsplash