DIGITAL IDENTITY MONTH: Choosing the best solutions for your business

The UK’s ecommerce and financial services sectors are constantly battling fraudsters who exploit vulnerabilities in online transactions. Digital identity verification solutions have become frontline tools in this fight, but with an abundance of providers, choosing the right partner can be daunting. Here are our top tips for anti-fraud professionals to source trusted digital identity verification solutions…

1. Go Beyond KYC/AML Compliance – Embrace Risk-Based Assessments:

While KYC (Know Your Customer) and AML (Anti-Money Laundering) compliance are essential, a one-size-fits-all approach won’t cut it. Look for providers offering risk-based assessments that tailor verification processes based on transaction risk levels. This streamlines the customer experience for low-risk transactions while strengthening verification for high-risk scenarios.

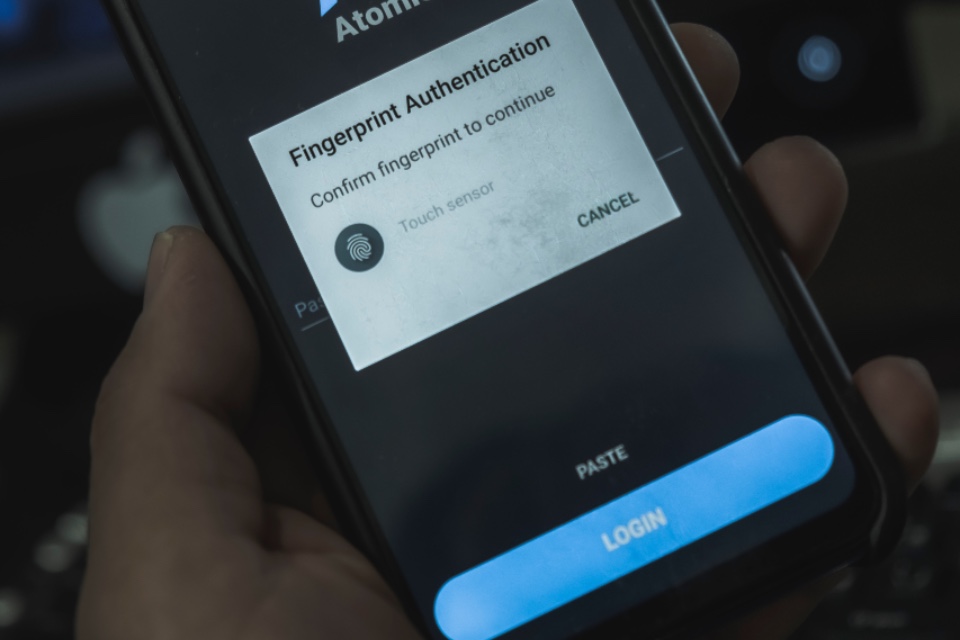

2. Prioritize Multi-Factor Authentication (MFA) and Biometrics:

Static password verification is easily compromised. Seek providers offering robust MFA solutions that combine factors like passwords, one-time codes, and biometrics (e.g., fingerprint scanning, facial recognition) for stronger authentication across all customer touchpoints.

3. Embrace Ongoing Monitoring and AI-Powered Solutions:

Fraudsters constantly evolve their tactics. Choose providers utilizing AI (Artificial Intelligence) and machine learning to continuously analyze customer behaviour and detect anomalies indicative of fraudulent activity. Real-time monitoring can prevent fraudulent transactions before they occur.

4. Seek Solutions with Global Reach and Regulatory Expertise:

For businesses operating internationally, a provider with a global reach and an in-depth understanding of international regulations is crucial. This ensures compliance with regional regulations like PSD2 (Payment Services Directive 2) in Europe, while still safeguarding transactions processed from diverse locations.

5. Prioritize Data Security and Transparency:

Data breaches can erode customer trust and lead to hefty fines. Partner with providers demonstrating a commitment to robust data security practices, including encryption, access controls, and regular penetration testing. Transparency about data usage and storage locations is also essential.

Bonus Tip: Collaboration is Key:

Consider partnering with a provider that fosters open communication and collaboration. Regularly share fraud trends and concerns with your chosen provider – joint efforts lead to more effective anti-fraud strategies.

By adopting these recommendations, anti-fraud professionals in the UK’s ecommerce and financial services sectors can confidently source trusted digital identity verification solutions. This strengthens the fight against fraud, boosts customer trust, and ultimately paves the way for a more secure and thriving digital economy.

Are you looking for Digital Identity Verification solutions for your organisation? The Fraud Prevention Summit can help!

Photo by Carson Arias on Unsplash